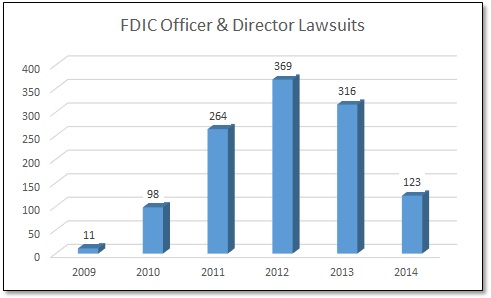

UPDATE 2: We in fact did see a significant decrease in O&D lawsuits in the past few years:

[pullquote]“The FDIC will not bring civil suits against directors and officers who fulfill their responsibilities, including the duties of loyalty and care, and who make reasonable business judgments on a fully informed basis and after proper deliberation.”[/pullquote]

UPDATE: Apparently one of the most common requests of the FDIC from bankers is for more technical assistance and training. The FDIC has responded, and I do not believe it is coincidental that the first set of new videos released is a new series titled “New Director Education Series” aimed at bank Directors.

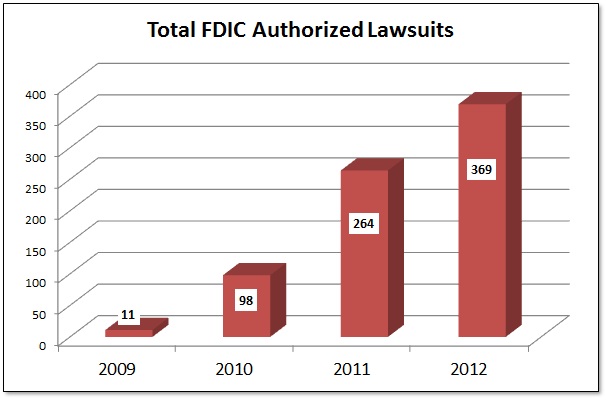

The numbers are in for 2012, and for the fourth year in a row the FDIC has filed a record number of officer and director lawsuits. According to the Statement Concerning the Responsibilities of Bank Directors and Officers adopted in 1992, the FDIC may sue professionals who they believe played a role in the failure of the institution. These individuals can include officers and directors, attorneys, accountants, appraisers, brokers, or others.

The FDIC regulations defining officer and director obligations are explained here, and the key concept to understand is something called the “duties of loyalty and care.”

“The duty of loyalty requires directors and officers to administer the affairs of the bank with candor, personal honesty and integrity. They are prohibited from advancing their own personal or business interests, or those of others, at the expense of the bank.”

So how can your officers and directors (and others) demonstrate the “duties of loyalty and care” and avoid liability claims? The FDIC spells it out, and it isn’t really that difficult:

“The FDIC will not bring civil suits against directors and officers who fulfill their responsibilities, including the duties of loyalty and care, and who make reasonable business judgments on a fully informed basis and after proper deliberation.”

Let’s break that last sentence down a bit. Officers and directors must demonstrate that they made…

- …reasonable business judgments…

- …on a fully informed basis, and…

- …after proper deliberation.

So working backwards, the key to proper deliberation is that you be fully informed, and that requires accurate, timely and relevant information. Not just data, but actionable information.

The key then, is that financial institutions must take steps to ensure that officers and directors have the information necessary to carry out their responsibilities, and that the deliberation process is appropriately documented. I’ve written before (Using Technology to Drive Compliance) about how technology (specifically automation) can enable and/or enhance your compliance efforts. Technology can help extract useful information from mountains of data, and then present that information in a consistent, easy to understand format.

Management committees like the IT committee and the audit committee can provide both a forum for both the exchange of information, and documentation that the exchange took place. Make sure all functional units are represented in the committee, and designate someone as the Board representative if possible. Make sure the committee reports to the Board periodically (preferably quarterly, but at least annually), and don’t underestimate the value of having outside expertise on those committees. Not only can it add a different perspective, it can also help document that you are truly making an effort to be “fully informed” and that you are “properly deliberating”.

Given the right information, in the right format, and the right setting, perhaps we’ll see this trend slow or even reverse itself in 2013!