Traditionally, the network administrator needed to operate at “ground-level”. Network maintenance was highly specialized and problematic, requiring a constant hands-on approach. And in the very early days (when the Guru started… “he who speaks of floppy disks”…) there were few formal training classes, most of what you learned was by trial and error…lots of error!

Today’s network administrator still has plenty of trial and error learning, but there is much less of it then there used to be. Consider this:

- How important is the Internet to your problem resolution process? Can you even imagine doing your job without the Internet?

- Colleges, universities and technical schools have had formal degree programs for training network administrators for years, assuring that even the most inexperienced admin has a broad base of knowledge to draw from starting on day one.

- Although server and desktop operating systems and applications are more complex today, they are also much (somewhat?) more stable than they used to be, with much more mature, feature-rich, administrative interfaces.

- Largely because of the first three items, there are a lot more resources available for support today. It’s often more cost effective to reach out to an expert in a particular area then it is to spend hours on trial and error.

- Most importantly though, many of the routine administrative tasks can now be automated and/or outsourced (patch management, AV updates, etc.), removing not only the drudgery of the task, but also removing the uncertainty of the human element as well. And as I’ve written about here, both auditors and examiners prefer automated controls for that very reason.

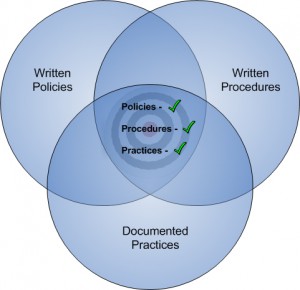

So the focus of the network administrator’s job has really evolved from a hands-on, high-touch, ground-level role, into more of a higher-level, managerial role. They still have primary responsibility in their traditional role of (as the FFIEC states), “…implementing the policies, standards, and procedures in their day-to-day operational role”, but they now often assist in the development of those policies as well. Most admins also sit on the IT steering committee, and in that capacity they also have the shared responsibility to coordinate the IT strategic plan, and by extension, the overall strategic plan. But it’s difficult to have an enterprise-wide view if you’re stuck in the trenches unlocking a user account or struggling with AV or patch updates.

Given the right tools, today’s network administrator is able to add value in many ways. Furthermore I don’t know of a single one that wouldn’t jump at the chance to assume a higher profile in their organization (with the associated increase in net value). If you are a network administrator, here are 3 ways you could get the conversation started:

- “You know, regulators are increasingly focusing on reporting to verify that we are following our procedures. Give me the tools I need to gather, analyze and report, and I’ll be able validate that we’re doing what we say we’re doing, the way we say we’re doing it. This should reduce our exposure to future regulatory findings.”

- “Recent experience has shown that auditors and examiners really prefer automated tools for routine repetitive tasks. An added advantage is that this will free me up to manage the process from a slightly different perspective, allowing me to not only apply controls, but assess their effectiveness as well.”

- “Effectively managing strategic risk means providing management with timely, actionable information that will allow them to rapidly respond and react to changes in the information landscape. Include me in the strategic planning process and I’ll be able to better understand the mission, and deliver the right information in the right format at the right time.”

And if you manage a network administrator and you haven’t had this discussion yet, don’t wait for them to approach you…ask them what you can do to elevate them above the drudgery, and get them more involved in managing the process instead of drowning in it. I’ll bet you’ll find a source of value you never knew you had!