“A topic is at times of such significant interest to bankers and examiners that it warrants a special issue…” Whenever something from a regulatory body begins this way all bankers should take notice, and the latest Special Corporate Governance Edition from the FDIC is no exception. In fact the Guru did a little research and the last time the FDIC released a Special Edition of its Supervisory Insights was the Foreclosure Edition in 2011, which was a post-mortem on the banking crisis.

So all bankers would be well advised to review this latest publication, but particularly community bankers. In fact the full title is: A Community Bank Director’s Guide to Corporate Governance: 21st Century Reflections on the FDIC Pocket Guide for Directors. The emphasis on community banks and bankers is intentional, and the release states right up front that:

“Community banks play a vital role in the nation’s economy and local communities, and a bank’s management – including its directors and senior management – is perhaps the single most important element in the successful operation of a bank.”

[pullquote]…a director’s responsibility…necessitates using independent judgment and providing a credible challenge (to management).[/pullquote]

Although the FDIC states that this does not constitute new guidance (the original Pocket Guide was issued almost 30 years ago, but the basics haven’t really changed), the fact that they chose this topic and this time to release a special issue indicates that this is almost certainly going to be an area of increased focus for examiners going forward.

If there is one common theme that resonates from this issue it is that directors are expected to play a more active role in the day-to-day affairs of their institutions, and NOT be simply a “rubber stamp” for management. This sums it up pretty well:

“…a director’s responsibility to oversee the conduct of the bank’s business necessitates using independent judgment and providing a credible challenge. This entails engaging in robust discussions with senior management and perhaps challenging recommendations at times, rather than simply deferring to their decisions.”

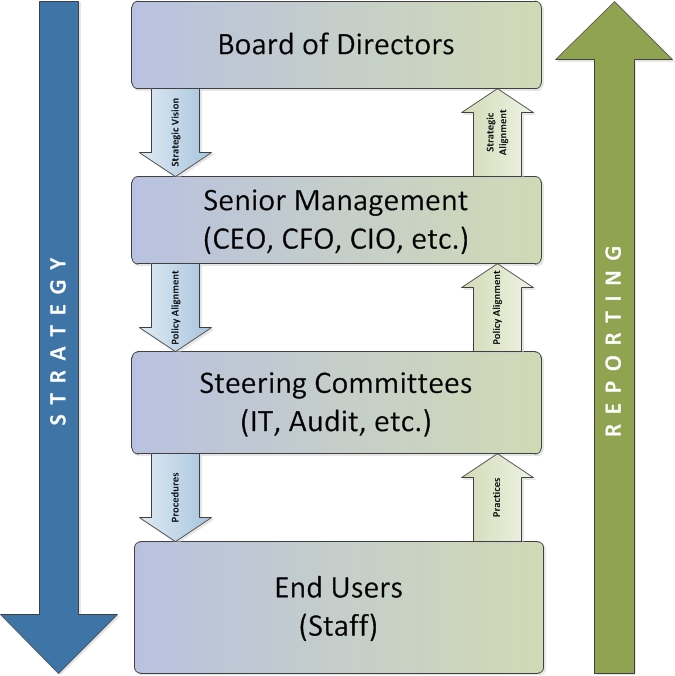

I’ve talked about this concept of “credible challenge” before, which also appears several times in the recent FFIEC Management Handbook, and is defined as “being actively engaged, asking thoughtful questions, and exercising independent judgment.” In order to do that, directors need access to accurate, timely and relevant information. Board reports, once very high-level, should now include sufficient detail to allow members to comprehend (and if necessary, challenge) management decisions.

Dispelling 5 IT Outsourcing Myths within Financial Institutions

Learn why some of the most commonly believed “facts” about IT outsourcing for banks are actually myths.

Make sure your IT management systems and processes are capable of producing these Board-level summary reports, then get them in front of the Board and in the Board minutes. And be prepared for 2 things going forward; first, examiners WILL ask for these Board minutes and expect to see evidence of more engagement. And secondly, expect Board meetings to become a lot more spirited!