Thankful for…Dodd-Frank?

I made a similar post last year about this time, so I thought I would continue the “Thanks-giving” tradition here…and no, I haven’t completely lost my mind about Dodd-Frank. Let me explain. Over the past year I’ve had the opportunity to give several presentations to various groups on the impact of Dodd-Frank (DFA) on community financial institutions, and I know the attitude out there on DFA ranges from cautious optimism to dread, but “Thankful”?!? Actually so far, overall, the impact had been negligible to slightly positive for community financial institutions (defined as <$1B in assets). But there is also reason for caution.

Reasons to be thankful

First and foremost among these are lower assessment rates. Lower deposit insurance assessments mean that the vast majority of community banks will see 30% – 40% decreases in their fees paid to the FDIC. And at the same time the amount of deposit insurance coverage has increased to $250,000. Getting more for less is always a good thing.

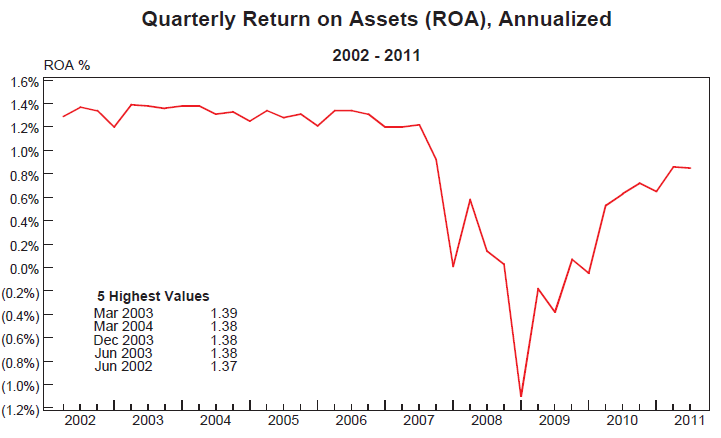

Although we can’t really credit this to Dodd-Frank, we can nevertheless also be thankful that financial institutions are for the most part healthier than they were last year at this time:

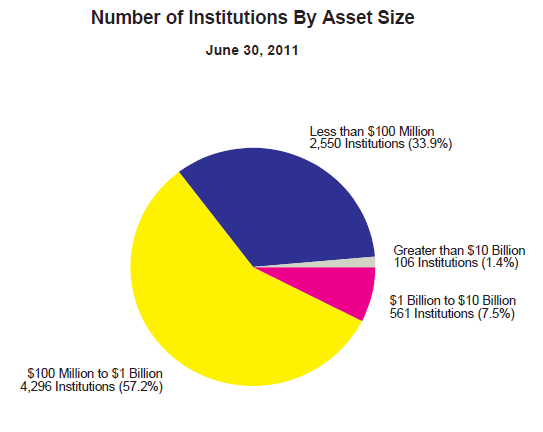

Another reason to be thankful is that the provision limiting debit card interchange fees does not apply to institutions with less than $10B in assets. In fact the vast majority of DFA provisions will only apply to institutions larger than $1B in assets, which as of June 2011 is only 8.9% of all financial institutions:

Reasons to be cautious

But as I said, there are still reasons to be cautious. According to DavisPolk in their latest Dodd-Frank Progress Report, 326 of the 400 rules required by the law have not yet been enacted, which, (regardless of whether or not community institutions will ultimately be affected) still leads to a climate of regulatory uncertainty. And there are couple of other more obscure provisions that will affect all institutions, like the Source of Financial Strength provision, and the requirement for risk committees to have outside directors, and of course whatever burdens the CFPB brings…stay tuned!

I mentioned previously that one of the reasons that I’m NOT thankful for DFA is that it raises the threshold for triggering a Material Loss Review from $25M to $200M, so we’ll have fewer post-failure reports to review. I believe the best way to avoid repeating the mistakes of the past is to learn from them, and the MLR’s were a great way to do that. I think they can also predict future examination trends…which is a preview of my next 2012 Trends post!

(I’d be remiss if I didn’t take this opportunity to express thanks for all the blog readers out there…over 11,000 visits since this time last year! THANK YOU!!)